Credit Rating Migration Risk

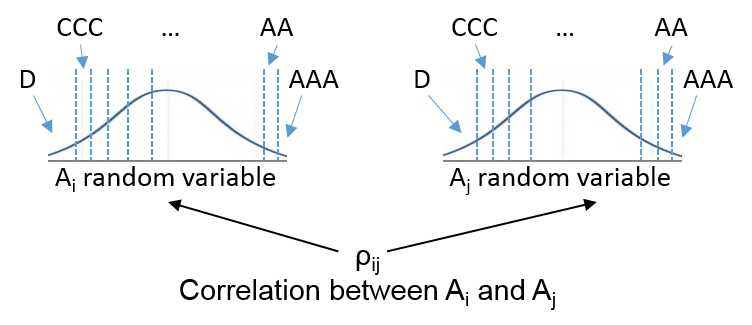

The migration-based multi-factor copula (creditMigrationCopula) is similar to the creditDefaultCopula object. As described in Credit Simulation Using Copulas, each counterparty’s credit quality is

represented by a “latent variable” which is simulated over many scenarios.

The latent variable is composed of a series of correlated factors which are weighted

based on the counterparty’s sensitivity to each factor. The two objects differ in how

the latent variables are used for the remainder of the analysis. Instead of thinking in

terms of probability of default for each obligor, the

creditMigrationCopula object works with each obligor’s credit

rating. Credit ratings are issued by several companies (S&P, Moody's, and so on).

Each rating represents a level of credit quality and ratings are changed periodically as

a company’s situation improves or deteriorates.

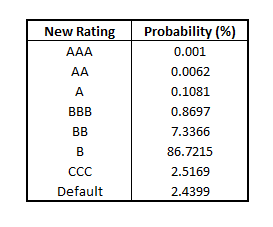

Given enough historical data, the likelihood is calculated that

a company at a particular rating will migrate to a different rating

over some time period. For example, this table shows the probabilities

that a company with credit rating "B" will

transition to each other rating.

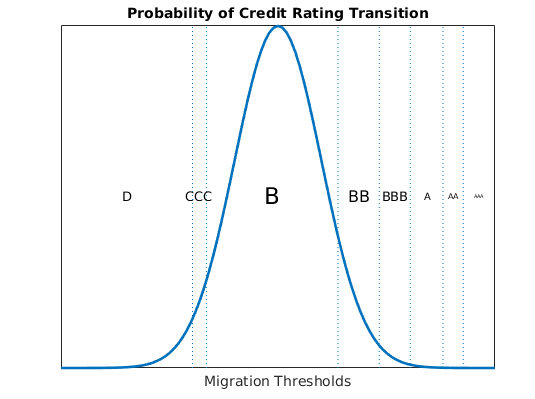

While the creditDefaultCopula object is concerned

with the 2.4% chance of default exclusively, a migration-based approach

using an creditMigrationCopula object accounts

for all possible rating states. Given these probabilities, the cut-points

are calculated for the distribution of all possible latent variable

values that correspond to each rating value.

For each scenario, the latent variable value determines the credit rating of the counterparty at the end of the time period based on these cut-points. The cut-points are set such that the probability of transitioning to each rating matches the probabilities in the provided transition table. You now have not just correlated defaults for each counterparty, but correlated rating changes across the entire range of credit ratings.

Each credit rating has a unique discount curve associated with

it. As an obligor’s credit rating falls, the obligor’s

bond cashflows become more deeply discounted and the total bond value

drops accordingly. Conversely, if an obligor’s rating improves,

the cashflows are discounted less deeply, and the bond values will

rise. After repricing the portfolio with all obligors’ new

ratings, the total portfolio value can be calculated as the sum of

the new bond values. As with the creditDefaultCopula object,

various risk measures are calculated and reported for the creditMigrationCopula object.

See Also

creditMigrationCopula | simulate | portfolioRisk | riskContribution | confidenceBands | getScenarios