Impute Missing Data in the Credit Scorecard Workflow Using the k-Nearest Neighbors Algorithm

This example shows how to perform imputation of missing data in the credit scorecard workflow using the k-nearest neighbors (kNN) algorithm.

The kNN algorithm is a nonparametric method used for classification and regression. In both cases, the input consists of the k-closest training examples in the feature space. The output depends on whether kNN is used for classification or regression. In kNN classification, an object is classified by a plurality vote of its neighbors, and the object is assigned to the class most common among its k-nearest neighbors. In kNN regression, the output is the average of the values of k-nearest neighbors. For more information on the kNN algorithm, see fitcknn.

For additional information on alternative approaches for "treating" missing data, see Credit Scorecard Modeling with Missing Values.

Impute Missing Data Using kNN Algorithm

Use the dataMissing data set to impute missing values for the CustAge (numeric) and ResStatus (categorical) predictors.

load CreditCardData.mat

disp(head(dataMissing)); CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate status

______ _______ ___________ ___________ _________ __________ _______ _______ _________ ________ ______

1 53 62 <undefined> Unknown 50000 55 Yes 1055.9 0.22 0

2 61 22 Home Owner Employed 52000 25 Yes 1161.6 0.24 0

3 47 30 Tenant Employed 37000 61 No 877.23 0.29 0

4 NaN 75 Home Owner Employed 53000 20 Yes 157.37 0.08 0

5 68 56 Home Owner Employed 53000 14 Yes 561.84 0.11 0

6 65 13 Home Owner Employed 48000 59 Yes 968.18 0.15 0

7 34 32 Home Owner Unknown 32000 26 Yes 717.82 0.02 1

8 50 57 Other Employed 51000 33 No 3041.2 0.13 0

In this example, the 'CustID' and 'status' columns are removed in the imputation process as those are the id and response values respectively. Alternatively, you can choose to leave the 'status' column in.

dataToImpute = dataMissing(:,setdiff(dataMissing.Properties.VariableNames,... {'CustID','status'},'stable'));

Create dummy variables for all categorical predictors so that the kNN algorithm can compute the Euclidean distances.

dResStatus = dummyvar(dataToImpute.ResStatus); dEmpStatus = dummyvar(dataToImpute.EmpStatus); dOtherCC = dummyvar(dataToImpute.OtherCC);

'k' in the kNN algorithm is based on feature similarity. Choosing the right value of 'k' is a process called parameter tuning, which is important for greater accuracy. There is no physical way to determine the "best" value for 'k', so you have to try a few values before settling on one. Small values of 'k' can be noisy and subject to the effects of outliers. Larger values of 'k' have smoother decision boundaries, which mean lower variance but increased bias.

For the purpose of this example, choose 'k' as the square root of the number of samples in the data set. This is a generally accepted value for 'k'. Choose a value of 'k' that is odd in order to break a tie between two classes of data.

numObs = height(dataToImpute); k = round(sqrt(numObs)); if ~mod(k,2) k = k+1; end

Get the missing values from the CustAge and ResStatus predictors.

missingResStatus = ismissing(dataToImpute.ResStatus); missingCustAge = ismissing(dataToImpute.CustAge);

Next, follow these steps:

custAgeToImpute = dataToImpute; custAgeToImpute.HomeOwner = dResStatus(:,1); custAgeToImpute.Tenant = dResStatus(:,2); custAgeToImpute.Employed = dEmpStatus(:,1); custAgeToImpute.HasOtherCC = dOtherCC(:,2); custAgeToImpute = removevars(custAgeToImpute, 'ResStatus'); custAgeToImpute = removevars(custAgeToImpute, 'EmpStatus'); custAgeToImpute = removevars(custAgeToImpute, 'OtherCC'); knnCustAge = fitcknn(custAgeToImpute, 'CustAge', 'NumNeighbors', k, 'Standardize',true); imputedCustAge = predict(knnCustAge,custAgeToImpute(missingCustAge,:)); resStatusToImpute = dataToImpute; resStatusToImpute.Employed = dEmpStatus(:,1); resStatusToImpute.HasOtherCC = dOtherCC(:,2); resStatusToImpute = removevars(resStatusToImpute, 'EmpStatus'); resStatusToImpute = removevars(resStatusToImpute, 'OtherCC'); knnResStatus = fitcknn(resStatusToImpute, 'ResStatus', 'NumNeighbors', k, 'Standardize', true); imputedResStatus = predict(knnResStatus,resStatusToImpute(missingResStatus,:));

Compare Imputed Data to Original Data

Create a new data set with the imputed data.

knnImputedData = dataMissing; knnImputedData.CustAge(missingCustAge) = imputedCustAge; knnImputedData.ResStatus(missingResStatus) = imputedResStatus; disp(knnImputedData(5:10,:));

CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate status

______ _______ ___________ __________ _________ __________ _______ _______ _________ ________ ______

5 68 56 Home Owner Employed 53000 14 Yes 561.84 0.11 0

6 65 13 Home Owner Employed 48000 59 Yes 968.18 0.15 0

7 34 32 Home Owner Unknown 32000 26 Yes 717.82 0.02 1

8 50 57 Other Employed 51000 33 No 3041.2 0.13 0

9 50 10 Tenant Unknown 52000 25 Yes 115.56 0.02 1

10 49 30 Home Owner Unknown 53000 23 Yes 718.5 0.17 1

disp(knnImputedData(find(missingCustAge,5),:));

CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate status

______ _______ ___________ __________ _________ __________ _______ _______ _________ ________ ______

4 52 75 Home Owner Employed 53000 20 Yes 157.37 0.08 0

19 45 14 Home Owner Employed 51000 11 Yes 519.46 0.42 1

138 41 31 Other Employed 41000 2 Yes 1101.8 0.32 0

165 37 21 Home Owner Unknown 38000 70 No 1217 0.2 0

207 48 38 Home Owner Employed 48000 12 No 573.9 0.1 0

disp(knnImputedData(find(missingResStatus,5),:));

CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate status

______ _______ ___________ __________ _________ __________ _______ _______ _________ ________ ______

1 53 62 Tenant Unknown 50000 55 Yes 1055.9 0.22 0

22 51 13 Tenant Employed 35000 33 Yes 468.85 0.01 0

33 46 8 Home Owner Unknown 32000 26 Yes 940.78 0.3 0

47 52 56 Tenant Employed 56000 79 Yes 294.46 0.12 0

103 64 49 Tenant Employed 50000 35 Yes 118.43 0 0

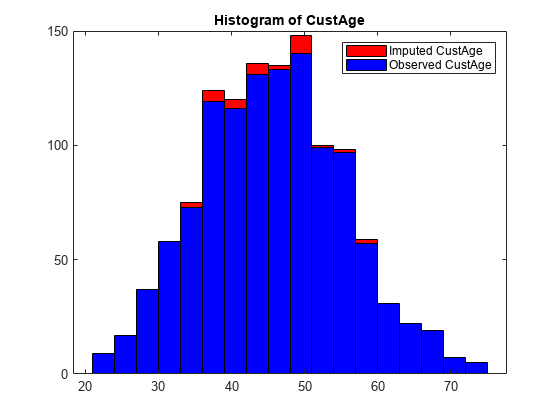

Plot a histogram of the predictor values before and after imputation.

Predictor ="CustAge"; f1 = figure; ax1 = axes(f1); histogram(ax1,knnImputedData.(Predictor),'FaceColor','red','FaceAlpha',1); hold on histogram(ax1,dataMissing.(Predictor),'FaceColor','blue','FaceAlpha',1); legend(strcat("Imputed ", Predictor), strcat("Observed ", Predictor)); title(strcat("Histogram of ", Predictor));

Create Credit Scorecard Model Using New Imputed Data

Use the imputed data to create the creditscorecard object, and then use autobinning, fitmodel, and formatpoints to create a credit scorecard model.

sc = creditscorecard(knnImputedData,'IDVar','CustID'); sc = autobinning(sc); [sc,mdl] = fitmodel(sc,'display','off'); sc = formatpoints(sc,'PointsOddsAndPDO',[500 2 50]); PointsInfo = displaypoints(sc); disp(PointsInfo);

Predictors Bin Points

______________ _____________________ ______

{'CustAge' } {'[-Inf,33)' } 53.893

{'CustAge' } {'[33,37)' } 55.874

{'CustAge' } {'[37,40)' } 57.89

{'CustAge' } {'[40,46)' } 68.976

{'CustAge' } {'[46,48)' } 77.972

{'CustAge' } {'[48,51)' } 80.576

{'CustAge' } {'[51,58)' } 81.041

{'CustAge' } {'[58,Inf]' } 97.002

{'CustAge' } {'<missing>' } NaN

{'ResStatus' } {'Tenant' } 62.974

{'ResStatus' } {'Home Owner' } 72.355

{'ResStatus' } {'Other' } 92.531

{'ResStatus' } {'<missing>' } NaN

{'EmpStatus' } {'Unknown' } 58.822

{'EmpStatus' } {'Employed' } 86.917

{'EmpStatus' } {'<missing>' } NaN

{'CustIncome'} {'[-Inf,29000)' } 30.381

{'CustIncome'} {'[29000,33000)' } 56.394

{'CustIncome'} {'[33000,35000)' } 67.979

{'CustIncome'} {'[35000,40000)' } 70.14

{'CustIncome'} {'[40000,42000)' } 70.938

{'CustIncome'} {'[42000,47000)' } 82.177

{'CustIncome'} {'[47000,Inf]' } 96.36

{'CustIncome'} {'<missing>' } NaN

{'TmWBank' } {'[-Inf,12)' } 51.08

{'TmWBank' } {'[12,23)' } 61.034

{'TmWBank' } {'[23,45)' } 61.833

{'TmWBank' } {'[45,71)' } 92.889

{'TmWBank' } {'[71,Inf]' } 133.05

{'TmWBank' } {'<missing>' } NaN

{'OtherCC' } {'No' } 50.819

{'OtherCC' } {'Yes' } 75.639

{'OtherCC' } {'<missing>' } NaN

{'AMBalance' } {'[-Inf,558.88)' } 89.8

{'AMBalance' } {'[558.88,1254.28)' } 63.083

{'AMBalance' } {'[1254.28,1597.44)'} 59.704

{'AMBalance' } {'[1597.44,Inf]' } 49.144

{'AMBalance' } {'<missing>' } NaN

Calculate Scores and Probability of Default for New Applicants

Create a data set of 'new customers' and then calculate the scores and probabilities of default.

dataNewCustomers = dataMissing(1:20,1:end-1); disp(head(dataNewCustomers));

CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate

______ _______ ___________ ___________ _________ __________ _______ _______ _________ ________

1 53 62 <undefined> Unknown 50000 55 Yes 1055.9 0.22

2 61 22 Home Owner Employed 52000 25 Yes 1161.6 0.24

3 47 30 Tenant Employed 37000 61 No 877.23 0.29

4 NaN 75 Home Owner Employed 53000 20 Yes 157.37 0.08

5 68 56 Home Owner Employed 53000 14 Yes 561.84 0.11

6 65 13 Home Owner Employed 48000 59 Yes 968.18 0.15

7 34 32 Home Owner Unknown 32000 26 Yes 717.82 0.02

8 50 57 Other Employed 51000 33 No 3041.2 0.13

Perform the same preprocessing on the 'new customers' data as on the training data.

dResStatusNewCustomers = dummyvar(dataNewCustomers.ResStatus); dEmpStatusNewCustomers = dummyvar(dataNewCustomers.EmpStatus); dOtherCCNewCustomers = dummyvar(dataNewCustomers.OtherCC); dataNewCustomersCopy = dataNewCustomers; dataNewCustomersCopy.HomeOwner = dResStatusNewCustomers(:,1); dataNewCustomersCopy.Tenant = dResStatusNewCustomers(:,2); dataNewCustomersCopy.Employed = dEmpStatusNewCustomers(:,1); dataNewCustomersCopy.HasOtherCC = dOtherCCNewCustomers(:,2); dataNewCustomersCopy = removevars(dataNewCustomersCopy, 'ResStatus'); dataNewCustomersCopy = removevars(dataNewCustomersCopy, 'EmpStatus'); dataNewCustomersCopy = removevars(dataNewCustomersCopy, 'OtherCC');

Predict the missing data in the scoring data set with the same imputation model as before.

missingCustAgeNewCustomers = isnan(dataNewCustomers.CustAge); missingResStatusNewCustomers = ismissing(dataNewCustomers.ResStatus); imputedCustAgeNewCustomers = round(predict(knnCustAge, dataNewCustomersCopy(missingCustAgeNewCustomers,:))); imputedResStatusNewCustomers = predict(knnResStatus, dataNewCustomersCopy(missingResStatusNewCustomers,:)); dataNewCustomers.CustAge(missingCustAgeNewCustomers) = imputedCustAgeNewCustomers; dataNewCustomers.ResStatus(missingResStatusNewCustomers) = imputedResStatusNewCustomers;

Use score to calculate scores of new customers.

[scores, points] = score(sc, dataNewCustomers); disp(scores);

530.8074 553.1893 504.7937 563.1458 552.3902 584.2455 443.9994 518.1807 526.0037 508.6677 498.0866 540.5789 516.2379 493.7192 566.0705 485.8408 476.3143 470.0189 541.1280 510.9479

disp(points);

CustAge ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance

_______ _________ _________ __________ _______ _______ _________

81.041 62.974 58.822 96.36 92.889 75.639 63.083

97.002 72.355 86.917 96.36 61.833 75.639 63.083

77.972 62.974 86.917 70.14 92.889 50.819 63.083

81.041 72.355 86.917 96.36 61.034 75.639 89.8

97.002 72.355 86.917 96.36 61.034 75.639 63.083

97.002 72.355 86.917 96.36 92.889 75.639 63.083

55.874 72.355 58.822 56.394 61.833 75.639 63.083

80.576 92.531 86.917 96.36 61.833 50.819 49.144

80.576 62.974 58.822 96.36 61.833 75.639 89.8

80.576 72.355 58.822 96.36 61.833 75.639 63.083

81.041 62.974 58.822 67.979 61.833 75.639 89.8

80.576 92.531 58.822 82.177 61.034 75.639 89.8

97.002 72.355 58.822 96.36 51.08 50.819 89.8

68.976 92.531 58.822 70.938 61.833 50.819 89.8

77.972 92.531 86.917 82.177 61.034 75.639 89.8

55.874 72.355 86.917 70.14 61.833 75.639 63.083

57.89 62.974 86.917 67.979 61.833 75.639 63.083

53.893 72.355 86.917 30.381 61.034 75.639 89.8

68.976 72.355 86.917 96.36 51.08 75.639 89.8

81.041 92.531 58.822 82.177 61.034 75.639 59.704