Creating the PortfolioMAD Object

To create a fully specified MAD portfolio optimization problem, instantiate the

PortfolioMAD object using PortfolioMAD. For information on the workflow when using

PortfolioMAD objects, see PortfolioMAD Object Workflow.

Syntax

Use PortfolioMAD to create an instance of

an object of the PortfolioMAD class. You can use the PortfolioMAD object in several ways.

To set up a portfolio optimization problem in a PortfolioMAD

object, the simplest syntax

is:

p = PortfolioMAD;

PortfolioMAD object, p, such

that all object properties are empty. The PortfolioMAD object also accepts

collections of argument name-value pair arguments for properties and their values.

The PortfolioMAD object accepts inputs

for public properties with the general

syntax:

p = PortfolioMAD('property1', value1, 'property2', value2, ... );If a PortfolioMAD object already exists, the syntax permits the

first (and only the first argument) of PortfolioMAD to be an existing object

with subsequent argument name-value pair arguments for properties to be added or

modified. For example, given an existing PortfolioMAD object in

p, the general syntax

is:

p = PortfolioMAD(p, 'property1', value1, 'property2', value2, ... );

Input argument names are not case-sensitive, but must be completely specified. In

addition, several properties can be specified with alternative argument names (see

Shortcuts for Property Names). The PortfolioMAD object tries to detect

problem dimensions from the inputs and, once set, subsequent inputs can undergo

various scalar or matrix expansion operations that simplify the overall process to

formulate a problem. In addition, a PortfolioMAD object is a

value object so that, given portfolio p, the following code

creates two objects, p and q, that are

distinct:

q = PortfolioMAD(p, ...)

PortfolioMAD Problem Sufficiency

A MAD portfolio optimization problem is completely specified with the

PortfolioMAD object if the following three conditions are

met:

You must specify a collection of asset returns or prices known as scenarios such that all scenarios are finite asset returns or prices. These scenarios are meant to be samples from the underlying probability distribution of asset returns. This condition can be satisfied by the

setScenariosfunction or with several canned scenario simulation functions.The set of feasible portfolios must be a nonempty compact set, where a compact set is closed and bounded. You can satisfy this condition using an extensive collection of properties that define different types of constraints to form a set of feasible portfolios. Since such sets must be bounded, either explicit or implicit constraints can be imposed and several tools, such as the

estimateBoundsfunction, provide ways to ensure that your problem is properly formulated.Although the general sufficient conditions for MAD portfolio optimization go beyond these conditions, the

PortfolioMADobject handles all these additional conditions.

PortfolioMAD Function Examples

If you create a PortfolioMAD object, p, with

no input arguments, you can display it using

disp:

p = PortfolioMAD; disp(p)

PortfolioMAD with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: []

Name: []

NumAssets: []

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: []

UpperBound: []

LowerBudget: []

UpperBudget: []

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []The approaches listed provide a way to set up a portfolio optimization problem

with the PortfolioMAD object. The custom set

functions offer additional ways to set and modify collections of properties in the

PortfolioMAD object.

Using the PortfolioMAD Function for a Single-Step Setup

You can use the PortfolioMAD object to directly

set up a “standard” portfolio optimization problem. Given

scenarios of asset returns in the variable AssetScenarios,

this problem is completely specified as

follows:

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

m = m/12;

C = C/12;

AssetScenarios = mvnrnd(m, C, 20000);

p = PortfolioMAD('Scenarios', AssetScenarios, ...

'LowerBound', 0, 'LowerBudget', 1, 'UpperBudget', 1)

PortfolioMAD with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: 20000

Name: []

NumAssets: 4

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: [4×1 double]

UpperBound: []

LowerBudget: 1

UpperBudget: 1

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []

LowerBound property value undergoes

scalar expansion since AssetScenarios provides the dimensions

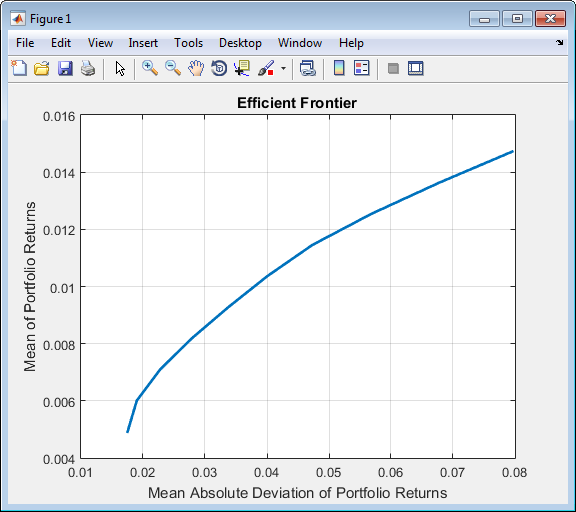

of the problem.You can use dot notation with the function plotFrontier.

p.plotFrontier

Using the PortfolioMAD Function with a Sequence of Steps

An alternative way to accomplish the same task of setting up a

“standard” MAD portfolio optimization problem, given

AssetScenarios variable is:

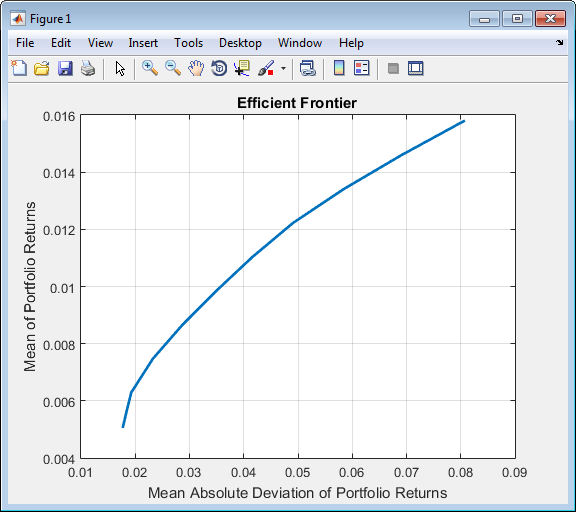

m = [ 0.05; 0.1; 0.12; 0.18 ]; C = [ 0.0064 0.00408 0.00192 0; 0.00408 0.0289 0.0204 0.0119; 0.00192 0.0204 0.0576 0.0336; 0 0.0119 0.0336 0.1225 ]; m = m/12; C = C/12; AssetScenarios = mvnrnd(m, C, 20000); p = PortfolioMAD; p = setScenarios(p, AssetScenarios); p = PortfolioMAD(p, 'LowerBound', 0); p = PortfolioMAD(p, 'LowerBudget', 1, 'UpperBudget', 1); plotFrontier(p);

This way works because the calls to the PortfolioMAD object are in this

particular order. In this case, the call to initialize

AssetScenarios provides the dimensions for the problem.

If you were to do this step last, you would have to explicitly dimension the

LowerBound property as follows:

m = [ 0.05; 0.1; 0.12; 0.18 ]; C = [ 0.0064 0.00408 0.00192 0; 0.00408 0.0289 0.0204 0.0119; 0.00192 0.0204 0.0576 0.0336; 0 0.0119 0.0336 0.1225 ]; m = m/12; C = C/12; AssetScenarios = mvnrnd(m, C, 20000); p = PortfolioMAD; p = PortfolioMAD(p, 'LowerBound', zeros(size(m))); p = PortfolioMAD(p, 'LowerBudget', 1, 'UpperBudget', 1); p = setScenarios(p, AssetScenarios);

Note

If you did not specify the size of LowerBound but,

instead, input a scalar argument, the PortfolioMAD object

assumes that you are defining a single-asset problem and produces an

error at the call to set asset scenarios with four assets.

Shortcuts for Property Names

The PortfolioMAD object has shorter

argument names that replace longer argument names associated with specific

properties of the PortfolioMAD object. For example, rather

than enter 'AInequality', the PortfolioMAD object accepts the

case-insensitive name 'ai' to set the

AInequality property in a PortfolioMAD

object. Every shorter argument name corresponds with a single property in the

PortfolioMAD object. The one

exception is the alternative argument name 'budget', which

signifies both the LowerBudget and

UpperBudget properties. When 'budget'

is used, then the LowerBudget and

UpperBudget properties are set to the same value to form

an equality budget constraint.

Shortcuts for Property Names

Shortcut Argument Name | Equivalent Argument / Property Name |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For example, this call to PortfolioMAD uses these shortcuts

for

properties:

m = [ 0.05; 0.1; 0.12; 0.18 ]; C = [ 0.0064 0.00408 0.00192 0; 0.00408 0.0289 0.0204 0.0119; 0.00192 0.0204 0.0576 0.0336; 0 0.0119 0.0336 0.1225 ]; m = m/12; C = C/12; AssetScenarios = mvnrnd(m, C, 20000); p = PortfolioMAD('scenario', AssetScenarios, 'lb', 0, 'budget', 1); plotFrontier(p);

Direct Setting of Portfolio Object Properties

Although not recommended, you can set properties directly using dot notation, however no error-checking is done on your inputs:

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

m = m/12;

C = C/12;

AssetScenarios = mvnrnd(m, C, 20000);

p = PortfolioMAD;

p = setScenarios(p, AssetScenarios);

p.LowerBudget = 1;

p.UpperBudget = 1;

p.LowerBound = zeros(size(m));

plotFrontier(p);

Note

Scenarios cannot be assigned directly using dot notation to a

PortfolioMAD object. Scenarios must always be set

through either the PortfolioMAD object, the

setScenarios function,

or any of the scenario simulation functions.