categoryReturnsChart

Description

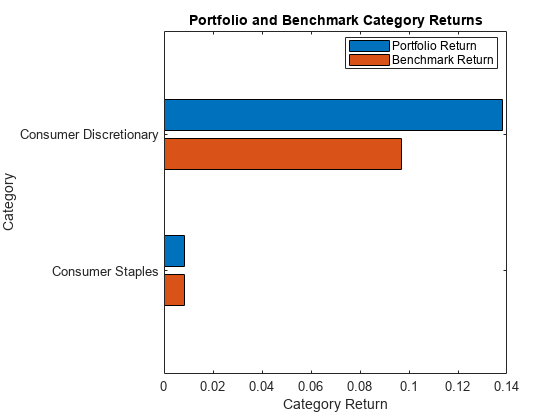

categoryReturnsChart( creates a

horizontal bar chart of portfolio and benchmark category returns, aggregated over all time

periods using a BrinsonPAObj)brinsonAttribution

object.

h = categoryReturnsChart(ax,BrinsonPAObj)h.

Examples

This example shows how to create a brinsonAttribution object that you can then use with the categoryReturnsChart function to generate a bar chart of category returns.

Prepare Data

Create a table for the monthly prices for four assets.

GM =[17.82;22.68;19.37;20.28]; HD = [39.79;39.12;40.67;40.96]; KO = [38.98;39.44;40.00;40.20]; PG = [56.38;57.08;57.76;55.54]; MonthlyPrices = table(GM,HD,KO,PG);

Use tick2ret to define the monthly returns.

MonthlyReturns = tick2ret(MonthlyPrices.Variables)'; [NumAssets,NumPeriods] = size(MonthlyReturns);

Define the periods.

Period = ones(NumAssets*NumPeriods,1); for k = 1:NumPeriods Period(k*NumAssets+1:end,1) = Period(k*NumAssets,1) + 1; end

Define the categories (sectors) for the four assets.

Name = repmat(string(MonthlyPrices.Properties.VariableNames(:)),NumPeriods,1); Categories = repmat(categorical([ ... "Consumer Discretionary"; ... "Consumer Discretionary"; ... "Consumer Staples"; ... "Consumer Staples"]),NumPeriods,1);

Define benchmark and portfolio weights.

BenchmarkWeight = repmat(1./NumAssets.*ones(NumAssets, 1),NumPeriods,1); PortfolioWeight = repmat([1;0;1;1]./3,NumPeriods,1);

Create AssetTable Input

Create AssetTable as the input for the brinsonAttribution object.

AssetTable = table(Period, Name, ... MonthlyReturns(:), Categories, PortfolioWeight, BenchmarkWeight, ... VariableNames=["Period","Name","Return","Category","PortfolioWeight","BenchmarkWeight"])

AssetTable=12×6 table

Period Name Return Category PortfolioWeight BenchmarkWeight

______ ____ _________ ______________________ _______________ _______________

1 "GM" 0.27273 Consumer Discretionary 0.33333 0.25

1 "HD" -0.016838 Consumer Discretionary 0 0.25

1 "KO" 0.011801 Consumer Staples 0.33333 0.25

1 "PG" 0.012416 Consumer Staples 0.33333 0.25

2 "GM" -0.14594 Consumer Discretionary 0.33333 0.25

2 "HD" 0.039622 Consumer Discretionary 0 0.25

2 "KO" 0.014199 Consumer Staples 0.33333 0.25

2 "PG" 0.011913 Consumer Staples 0.33333 0.25

3 "GM" 0.04698 Consumer Discretionary 0.33333 0.25

3 "HD" 0.0071306 Consumer Discretionary 0 0.25

3 "KO" 0.005 Consumer Staples 0.33333 0.25

3 "PG" -0.038435 Consumer Staples 0.33333 0.25

Create brinsonAttribution Object

Use brinsonAttribution to create the brinsonAttribution object.

BrinsonPAobj = brinsonAttribution(AssetTable)

BrinsonPAobj =

brinsonAttribution with properties:

NumAssets: 4

NumPortfolioAssets: 3

NumBenchmarkAssets: 4

NumPeriods: 3

NumCategories: 2

AssetName: [4×1 string]

AssetReturn: [4×3 double]

AssetCategory: [4×3 categorical]

PortfolioAssetWeight: [4×3 double]

BenchmarkAssetWeight: [4×3 double]

PortfolioCategoryReturn: [2×3 double]

BenchmarkCategoryReturn: [2×3 double]

PortfolioCategoryWeight: [2×3 double]

BenchmarkCategoryWeight: [2×3 double]

PortfolioReturn: 0.0598

BenchmarkReturn: 0.0540

ActiveReturn: 0.0059

Generate Horizontal Bar Chart for Category Returns

Use the brinsonAttribution object with categoryReturnsChart to generate a horizontal bar chart of portfolio and benchmark category returns, aggregated over all time periods.

categoryReturnsChart(BrinsonPAobj)

Input Arguments

brinsonAttribution object to analyze performance attribution. Use

brinsonAttribution to

create the brinsonAttribution object.

Data Types: object

(Optional) Valid axis object, specified as an ax object that you

create using axes.

categoryReturnsChart creates the plot on the axes specified by the

optional ax argument instead of on the current axes (gca). The

optional argument ax can precede any of the input argument

combinations. If you do not specify an axes object,

categoryReturnsChart plots into the current axes.

Data Types: object

Output Arguments

Figure handle for the category returns chart, returned as handle object. You can use the figure handle to access and change the properties of the chart.

Version History

Introduced in R2023a

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Seleziona un sito web

Seleziona un sito web per visualizzare contenuto tradotto dove disponibile e vedere eventi e offerte locali. In base alla tua area geografica, ti consigliamo di selezionare: .

Puoi anche selezionare un sito web dal seguente elenco:

Come ottenere le migliori prestazioni del sito

Per ottenere le migliori prestazioni del sito, seleziona il sito cinese (in cinese o in inglese). I siti MathWorks per gli altri paesi non sono ottimizzati per essere visitati dalla tua area geografica.

Americhe

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)